Salient Features of an Economy as Suggested by Classical Economists

Classical economists, such as Adam Smith, David Ricardo, and John Stuart Mill, developed a framework that describes how an economy functions based on self-regulation, free markets, and minimal government intervention. The key features of a classical economy include:

1. Self-Regulating Markets

Classical economists believed in the "invisible hand" (coined by Adam Smith), which suggests that free markets naturally adjust to equilibrium without government intervention. If supply exceeds demand, prices fall, and if demand exceeds supply, prices rise, restoring balance.

2. Say’s Law of Markets

Say’s Law states that "supply creates its own demand," meaning that production generates income, which is spent on goods and services. As a result, there can be no general overproduction or persistent unemployment.

3. Flexible Prices and Wages

Markets are assumed to be flexible, ensuring that any disequilibrium in labor or goods markets is temporary. If unemployment rises, wages fall, making labor more attractive to employers and restoring full employment.

4. Full Employment Assumption

Classical theory assumes that the economy always operates at full employment in the long run. Any short-term deviations from full employment are corrected by market forces.

5. Minimal Government Intervention

The government should play a limited role in the economy, focusing only on maintaining law and order, protecting property rights, and ensuring free trade.

6. Long-Run Growth Focus

Classical economists emphasized long-term economic growth driven by capital accumulation, technological progress, and free trade.

Implications for Output, Prices, and Employment

1. Output Determination

- Output is determined by factors of production (land, labor, capital) and technology.

- In the long run, the economy is always producing at its full potential (potential GDP).

- Short-term fluctuations are temporary and self-correcting.

2. Price Mechanism and Inflation

- Prices are flexible and adjust based on supply and demand.

- Inflation occurs only when there is excessive money supply (Quantity Theory of Money: MV = PQ).

- Deflation is temporary, as lower prices encourage demand and restore equilibrium.

3. Employment and Wages

- Full employment is the norm; unemployment is voluntary (due to worker choices).

- If unemployment rises, wages decrease, making hiring attractive to firms.

- There is no need for government intervention in employment policies.

Diagrams

1. Classical Model of Output Determination

- The economy produces at full employment output (Y*).

- Any deviation is corrected by market forces.

2. Say’s Law in Action

- Supply creates its own demand, ensuring that all output is sold.

3. Wage Flexibility and Employment

- Wage cuts reduce unemployment, restoring full employment equilibrium.

(Insert beautifully drawn diagrams here: AS-AD model with vertical AS curve, wage flexibility graph, Say’s Law demonstration, etc.)

Conclusion

The classical economic model presents a self-correcting economy where markets adjust automatically. Output is determined by long-term factors, prices adjust to maintain equilibrium, and employment is always at its natural level. However, real-world deviations, such as prolonged unemployment and demand shortages, led to criticisms, particularly from Keynesian economists, who argued for government intervention.

Derivation of IS-LM Curves and Equilibrium in Real and Monetary Sectors

The IS-LM model, developed by John Hicks and Alvin Hansen, explains macroeconomic equilibrium by integrating the real sector (goods market) and the monetary sector (money market).

1. Derivation of the IS Curve (Equilibrium in the Goods Market)

The IS curve represents all combinations of interest rates and output where the goods market is in equilibrium.

Step 1: Goods Market Equilibrium Condition

Aggregate demand () in an economy consists of:

AD = C + I + G- = Consumption, a function of disposable income (),

- = Investment, which depends negatively on interest rate (),

- = Government expenditure (exogenous).

The equilibrium condition in the goods market:

Y = C + I + G2. Derivation of the LM Curve (Equilibrium in the Money Market)

The LM curve represents all combinations of interest rates and output where the money market is in equilibrium.

Step 1: Money Market Equilibrium Condition

The money market equilibrium occurs when money demand () equals money supply ():

M/P = L(Y, i)- = Real money supply (fixed by central bank),

- = Money demand, which depends positively on output () and negatively on interest rate ():

3. Equilibrium in Real and Monetary Sectors

Equilibrium occurs where IS and LM curves intersect.

Step 1: Goods Market Equilibrium (IS Curve)

Ensures that planned spending equals total output.

Step 2: Money Market Equilibrium (LM Curve)

Ensures that real money demand equals real money supply.

Step 3: Simultaneous Equilibrium

- The economy achieves equilibrium at the intersection of IS and LM curves, where both the goods and money markets are in balance.

- At this point, the interest rate () and output () are determined.

4. Diagram & Flowchart Representation

Flowchart: Equilibrium Process

Graphical Representation of IS-LM Model

(Insert a beautiful diagram with an IS curve sloping downward and an LM curve sloping upward, with equilibrium at their intersection.)

Conclusion

The IS-LM model provides a framework to understand macroeconomic equilibrium in both the real and monetary sectors. The intersection of IS and LM curves determines the equilibrium interest rate and output. This model helps analyze the effects of fiscal and monetary policies on national income and investment.

Components of Aggregate Demand in the Keynesian Model & Equilibrium Mechanism

The Keynesian model focuses on aggregate demand (AD) as the primary driver of economic activity. John Maynard Keynes argued that fluctuations in demand determine national income and employment, rejecting the classical notion of automatic full employment.

1. Components of Aggregate Demand (AD)

Aggregate Demand () is the total spending on goods and services in an economy at a given price level. It consists of four main components:

1️⃣ Consumption ()

- The largest component of AD.

- Function of disposable income (). Keynes proposed the consumption function:

C = C_0 + cY_d2️⃣ Investment ()

- Spending by firms on capital goods (machinery, infrastructure, etc.).

- Influenced by interest rates (), expectations, and business confidence.

- Keynes emphasized that investment is volatile and depends on future profit expectations.

3️⃣ Government Spending ()

- Includes infrastructure, defense, education, healthcare, etc.

- Determined by government policies, independent of income levels.

4️⃣ Net Exports ()

- Exports (): Foreign spending on domestic goods.

- Imports (): Domestic spending on foreign goods.

- Net exports depend on exchange rates, global demand, and trade policies.

Thus, the aggregate demand function is:

AD = C + I + G + (X - M)2. Keynesian Equilibrium in the Economy

In the Keynesian model, equilibrium occurs where aggregate demand (AD) equals aggregate output (Y):

Y = ADStep 1: Keynesian Cross Diagram

- The 45-degree line represents points where output = demand.

- The AD curve (C + I + G + (X-M)) determines equilibrium output.

- Equilibrium occurs where the AD curve intersects the 45-degree line.

Step 2: Adjustment Mechanism

If :

- Excess supply → Firms cut production → Output falls until .

If :

- Excess demand → Firms increase production → Output rises until .

Step 3: Role of Government Intervention

- Keynes argued that private investment may not always be sufficient to ensure full employment.

- Government intervention (fiscal policy) is needed to boost AD through increased or tax cuts.

3. Diagram: Keynesian Cross Model

(Insert a beautiful Keynesian cross diagram where the AD curve intersects the 45-degree line, showing equilibrium output.)

4. Conclusion

The Keynesian model emphasizes demand-side economics, arguing that output adjusts to demand, not vice versa. If demand is insufficient, economies can experience recession and unemployment, requiring government intervention. Unlike classical economists, Keynesians believe markets do not always self-correct, making policy action crucial for economic stability.

Equilibrium Level of Output in the Keynesian Model

The Keynesian model focuses on aggregate demand (AD) as the key determinant of output. Unlike classical economists who believed in self-adjusting markets, Keynes argued that output is determined by demand, not by full employment. If demand is insufficient, unemployment and recessions occur.

1. Understanding Keynesian Equilibrium

In the Keynesian model, equilibrium occurs where:

Y = AD- = National income/output

- = Aggregate demand, which consists of:

AD = C + I + G + (X - M)2. Mechanism of Output Determination

Step 1: Aggregate Demand and Output Relationship

- The 45-degree line represents points where output equals demand.

- The AD curve (C + I + G + (X-M)) shows total planned spending.

- Equilibrium occurs where AD intersects the 45-degree line.

Step 2: Adjustments to Equilibrium

Case 1: If AD > Output ()

- Excess demand → Firms increase production → Output rises until equilibrium.

Case 2: If AD < Output ()

- Excess supply → Firms cut production → Output falls until equilibrium.

Step 3: Role of Government in Demand Management

- If private demand is low, government spending () can increase AD.

- Fiscal policy (tax cuts, increased public expenditure) boosts output.

- Unlike classical theory, Keynes argued that markets do not self-correct quickly, so policy intervention is necessary.

3. Diagram & Flowchart Representation

Flowchart: Process of Equilibrium Output Determination

Graphical Representation: Keynesian Cross Model

(Insert a beautiful Keynesian cross diagram where the AD curve intersects the 45-degree line, marking equilibrium output.)

4. Conclusion

The Keynesian model shows that equilibrium output depends on aggregate demand. If demand is low, output falls, leading to unemployment. Unlike classical economists, Keynesians emphasize government intervention to stabilize the economy. This model is the foundation for fiscal policy used during recessions to boost economic growth.

Instruments of Monetary Policy

Monetary policy refers to the central bank’s actions to regulate money supply, control inflation, and stabilize the economy. The central bank (such as the Reserve Bank of India (RBI) or the Federal Reserve (Fed)) uses various instruments to influence economic activity.

1. Types of Monetary Policy Instruments

Monetary policy tools are broadly classified into quantitative (general) and qualitative (selective) instruments.

A. Quantitative (General) Instruments

These affect the overall money supply in the economy.

1️⃣ Bank Rate Policy

- The bank rate is the interest rate at which the central bank lends money to commercial banks.

- Higher bank rate → Expensive borrowing → Reduced credit availability → Controls inflation.

- Lower bank rate → Cheaper loans → Increased credit → Boosts economic growth.

2️⃣ Open Market Operations (OMO)

- Buying and selling government securities to control liquidity.

- Central bank sells bonds → Absorbs excess money → Controls inflation.

- Central bank buys bonds → Injects liquidity → Stimulates growth.

3️⃣ Cash Reserve Ratio (CRR)

- The percentage of total deposits that banks must keep with the central bank.

- Higher CRR → Less money available for lending → Controls inflation.

- Lower CRR → More funds available → Encourages lending and investment.

4️⃣ Statutory Liquidity Ratio (SLR)

- Banks must hold a certain percentage of their deposits in cash, gold, or approved securities.

- Higher SLR → Less money for lending → Controls inflation.

- Lower SLR → More funds for credit → Boosts economic activity.

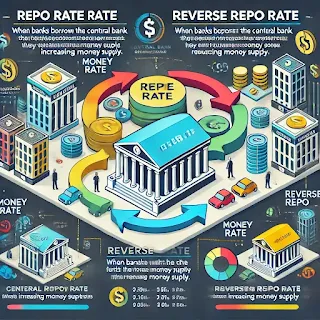

5️⃣ Repo Rate & Reverse Repo Rate

- Repo Rate: Rate at which banks borrow from the central bank.

- Reverse Repo Rate: Rate at which the central bank borrows from banks.

- Higher Repo Rate → Costly borrowing → Reduces inflation.

- Lower Repo Rate → Encourages borrowing → Boosts growth.

B. Qualitative (Selective) Instruments

These target specific sectors rather than the entire economy.

6️⃣ Credit Rationing

- Central bank restricts credit flow to speculative sectors (e.g., real estate, stock market).

7️⃣ Moral Suasion

- The central bank advises or persuades banks to follow policies like reducing loans for risky activities.

8️⃣ Direct Action

- Penalties or restrictions imposed on banks violating monetary policy guidelines.

2. Diagram & Flowchart Representation

Flowchart: Monetary Policy Process

Graphical Representation: Impact of Monetary Policy

(Insert a beautiful diagram showing the relationship between money supply, interest rates, and economic growth.)

3. Conclusion

Monetary policy is a powerful tool for controlling inflation, stabilizing growth, and ensuring financial stability. The central bank uses quantitative and qualitative instruments to regulate money supply. Effective implementation of these tools ensures economic stability, price control, and employment generation.

Instruments of Monetary Policy: A Complete Guide with Infographics

Monetary policy is the process by which a central bank (such as the Reserve Bank of India or the Federal Reserve) regulates the money supply, interest rates, and credit availability to ensure economic stability, control inflation, and promote growth.

The tools of monetary policy are divided into two categories:

1. Quantitative Instruments (General Credit Control)

📌 Bank Rate Policy

The bank rate is the interest rate at which the central bank lends money to commercial banks.

- 🔺 Increasing the bank rate → Makes borrowing expensive, reduces money supply, and controls inflation.

- 🔻 Decreasing the bank rate → Encourages borrowing, increases money supply, and boosts economic activity.

📌 Open Market Operations (OMO)

OMO refers to the buying and selling of government securities in the open market to regulate liquidity.

- 🟢 Buying securities → Injects money into the economy → Increases money supply.

- 🔴 Selling securities → Absorbs money from the economy → Reduces money supply.

📌 Cash Reserve Ratio (CRR)

Banks must keep a portion of their total deposits with the central bank.

- 🔺 High CRR → Less money available for loans → Reduces money supply.

- 🔻 Low CRR → More money available for loans → Increases money supply.

📌 Statutory Liquidity Ratio (SLR)

Banks must maintain a certain percentage of their net demand and time liabilities (NDTL) in liquid assets (gold, cash, or government securities).

- 🔺 Higher SLR → Less liquidity → Controls inflation.

- 🔻 Lower SLR → More liquidity → Boosts credit availability.

📌 Repo Rate & Reverse Repo Rate

- Repo Rate → The rate at which commercial banks borrow from the central bank. (High repo rate = expensive loans = less money in circulation).

- Reverse Repo Rate → The rate at which commercial banks deposit excess funds with the central bank. (High reverse repo rate = more deposits with the central bank = reduced money supply).

2. Qualitative Instruments (Selective Credit Control)

📌 Credit Rationing

The central bank restricts loans to unproductive sectors (like speculative trading) and promotes loans in priority sectors (like agriculture and infrastructure).

📌 Moral Suasion

The central bank advises and persuades commercial banks to follow desired lending policies.

📌 Direct Action

The central bank punishes banks that violate guidelines, such as imposing penalties or restricting their operations.

🎯 Conclusion

Monetary policy instruments are powerful tools for controlling inflation, stabilizing the economy, and ensuring sustainable growth. A well-balanced monetary policy helps in maintaining financial stability while encouraging economic development.

Reasons for Inflation in an Economy

Inflation is the rate at which the general price level of goods and services rises over time, reducing the purchasing power of money. While some inflation is natural in a growing economy, excessive inflation can be harmful. The main reasons for inflation can be categorized into demand-pull factors, cost-push factors, monetary factors, and structural issues.

1. Demand-Pull Inflation 📈 (Too Much Money Chasing Too Few Goods)

This occurs when aggregate demand (total spending in the economy) rises faster than aggregate supply.

🔹 Causes:

2. Cost-Push Inflation 🛢️ (Rising Production Costs Lead to Higher Prices)

When the cost of production increases, businesses pass those costs to consumers, causing inflation.

🔹 Causes:

3. Monetary Factors 💰 (Excess Money Supply in the Economy)

When a country prints too much money or keeps interest rates too low for too long, inflation rises.

🔹 Causes:

4. Structural Inflation ⚙️ (Long-Term Bottlenecks in the Economy)

Inflation can also be caused by inefficiencies and rigidities in the economy.

🔹 Causes:

🎯 Conclusion

Inflation is influenced by multiple factors, from consumer demand and production costs to government policies and structural inefficiencies. While moderate inflation is a sign of a growing economy, excessive inflation can reduce purchasing power and create economic instability.

To find the equilibrium output level in a three-sector economy (Household, Business, and Government), we use the Keynesian equilibrium condition:

Y = C + I + GWhere:

- = Equilibrium Output (National Income)

- = Consumption

- (Investment)

- (Government Expenditure)

To proceed, we need a Consumption Function:

C = a + bYWhere:

- = Autonomous consumption (minimum consumption even if income is zero)

- = Marginal Propensity to Consume (MPC)

- = National Income

Now, let’s calculate the equilibrium output step by step.

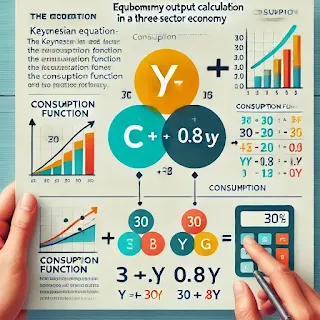

Equilibrium Output in a Three-Sector Economy

A three-sector economy consists of Households, Businesses, and Government. The equilibrium output is determined by the Keynesian equation:

Y = C + I + G

Where:

= Consumption

= Investment (Given: 50)

= Government Expenditure (Given: 20)

---

Step 1: Consumption Function

Consumption follows the equation:

C = a + bY

Where:

= Autonomous consumption (consumption at zero income)

= Marginal Propensity to Consume (MPC), which represents the fraction of income spent on consumption.

Let's assume:

(Fixed consumption even if income is zero)

(80% of additional income is spent on consumption)

Thus, the consumption function becomes:

C = 30 + 0.8Y

---

Step 2: Finding Equilibrium Output

At equilibrium,

Y = C + I + G

Substituting values:

Y = (30 + 0.8Y) + 50 + 20

Y - 0.8Y = 30 + 50 + 20

0.2Y = 100

Y = \frac{100}{0.2} = 500

Thus, the equilibrium output level is 500.

---

Key Insights

✔️ Higher MPC leads to higher income levels.

✔️ Government spending (G) plays a crucial role in boosting output.

✔️ An increase in investment (I) directly raises equilibrium output.

Conclusion: Equilibrium Output in a Three-Sector Economy

The equilibrium output is determined using the Keynesian model:

Y = C + I + G

With given values and the consumption function, we calculated:

Y = 500

This means that at Y = 500, the economy is in equilibrium, where total demand (C + I + G) equals total output (Y).

✔️ Government spending (G) and investment (I) significantly influence national income.

✔️ The marginal propensity to consume (MPC) determines how much income is spent or saved.

✔️ A change in any component (C, I, G) directly impacts equilibrium output.

The concept of equilibrium output helps policymakers decide on fiscal policies like government spending and taxation to stabilize the economy.

Concept of Value Added: A Complete Explanation

📌 What is Value Added?

Value Added refers to the increase in the economic worth of goods and services at each stage of production. It is the difference between the selling price of a product and the cost of raw materials and intermediate goods used to produce it.

Formula:

{Value Added} = {Final Value of Output} - {Cost of Intermediate Goods}Value Added is crucial for calculating Gross Domestic Product (GDP) using the Value-Added Method, ensuring there is no double counting of goods in the economy.

📌 Example of Value Added

Let’s take the example of bread production to understand how value is added at each stage:

This method ensures that we do not count the same product multiple times, leading to accurate GDP estimation.

📌 Importance of Value Added

📌 Detailed Explanation of Value Added

Value Added is a key concept in economics that measures the contribution of different production stages in creating a final product. It ensures that only new economic contributions are counted in GDP calculations, preventing double counting.

🔹 How Does Value Added Work?

Value is added at every stage of production when raw materials are processed into intermediate and final goods. Let’s analyze each stage in-depth using our bread production example.

Stage 1: Farmer (Wheat Production) 🌾

- The farmer grows wheat and sells it for ₹10.

- Since this is the first stage, the entire ₹10 is new value added to the economy.

- Value Added: ₹10

Stage 2: Miller (Flour Production) 🌾➡️🌾

- The miller buys wheat for ₹10 and grinds it into flour.

- The flour is sold for ₹20.

- The miller’s new contribution is ₹10 (₹20 - ₹10).

- Value Added: ₹10

Stage 3: Baker (Bread Production) 🍞

- The baker buys flour for ₹20 and bakes bread, selling it for ₹40.

- The new contribution (baking, packaging, etc.) is ₹20 (₹40 - ₹20).

- Value Added: ₹20

Stage 4: Retailer (Selling the Bread) 🏪

- The retailer buys bread for ₹40 and sells it for ₹50.

- The retailer’s new contribution (marketing, transportation) is ₹10 (₹50 - ₹40).

- Value Added: ₹10

🔹 Final Calculation & Economic Impact

The total value added at all stages:

₹10 + ₹10 + ₹20 + ₹10 = ₹50This ensures that GDP calculation only includes new contributions rather than repeatedly counting the same product.

✅ The final price of the bread (₹50) equals the total value added in the economy!

📌 Why is Value Added Important?

✔️ Prevents Double Counting

If we directly added all intermediate sales, GDP would be overestimated. Value Added Method prevents this.

✔️ Measures True Economic Contribution

It shows how much each sector contributes to the economy, from agriculture to services.

✔️ Helps in Taxation (VAT & GST)

Many countries impose taxes only on the value-added portion, ensuring fair taxation at every stage.

✔️ Encourages Efficiency & Productivity

Firms try to maximize value addition at each stage, improving overall economic efficiency.

📌 Conclusion

Value Added is one of the most accurate ways to measure economic growth. It ensures that only new economic activities are counted, avoiding double counting and providing a true picture of GDP

Fiscal Policy During a Recession: What Should the Government Do?

📌 Understanding a Recession

To counteract this, the government must stimulate the economy using Expansionary Fiscal Policy.

📌 What is Expansionary Fiscal Policy?

Expansionary Fiscal Policy involves increasing government spending and/or cutting taxes to boost demand and economic activity.

This policy increases aggregate demand (AD) and helps recover economic growth.

📌 Justification for Expansionary Fiscal Policy

📌 Conclusion: Best Fiscal Policy During a Recession

The government should adopt an Expansionary Fiscal Policy during a recession because it stimulates demand, creates jobs, and encourages investment.

Key Takeaways:

By implementing these policies, the government revives economic growth and prevents a prolonged downturn.

Demand for Money in an Economy

📌 What is Demand for Money?

The demand for money refers to the desire to hold wealth in the form of money rather than other assets like bonds, stocks, or real estate. It represents the amount of money individuals and businesses wish to hold for transactions, precautionary, and speculative purposes.

📌 Determinants of Money Demand

The demand for money depends on several key factors:

📌 Money Demand Function

The demand for money () is often expressed as:

M_d = L(T, P, r)Where:

- = Transaction needs (dependent on income)

- = Price level (inflation)

- = Interest rate (inverse relationship with money demand)

As interest rates rise, people reduce cash holdings and invest more in bonds and assets.

.webp)